Forensic Investigations and Dispute Advisory Services

Any unforeseen crisis – be it a data breach, fraud, or a massive pandemic – can severely damage an organization by undermining the confidence of customers and stakeholders. However, if handled correctly, this type of change can also open up new possibilities for your business to grow stronger. As your trusted advisor, CLAIVC’s Forensics team will help you get back on the right track. We work with you to mitigate risk and implement measures to safeguard business value by the way of preventive and detective forensic practices.

We are:

- One of the Fastest growing FIDAS practice outside Big 4.

- Delivered Marquee Forensic engagements which enable us to take a lead position in Banking Fraud Solutions.

- Enhanced capabilities in Arbitration and Dispute to assist leading India and Global Law Firms.

Our Forensic Service Offerings

- Quantification of Losses, Damages and Claims in Disputes

- Expert Witness for Commercial Disputes

- Party Appointed Expert Witness

- Opinion and Testimony

- Cross Examination Support

- Construction Delay Analysis

- Claims for Intellectual Property disputes

- Managed Document Reviews

- Insurance Claim Quantification

- Whistle Blower and Internal Investigation

- Compliance Investigation

- Intellectual Property Investigation

- Fraud Risk Assessments

- Integrity Due Diligence Support

- Market Intelligence

- Mystery Shopping

- Anti-Trust Investigation

- Digital Investigation

- Forensic Collections & ESI Review

- eDiscovery Services

- Forensic Data Analytics

- Financial Crime Analytics

- Cyber Forensic

- Forensic Audit, Asset Tracing and Anti Money Laundering

- Forensic Audit

- Transaction Audit

- Asset Tracing India and Globally

- Review of End use of Funds/Misappropriation of Funds

- Cash Flow Monitoring

- Anti Money Laundering Monitoring and Investigations

- Know Your Customer/AML System Review

- FCPA /UK Bribery Act/Spain II advisory and Due Diligence

- Bribery and Corruption Investigations

- Ethics & Integrity

- POSH Violations

Why Choose Us?

FIDAS Practice Overview

Growth Overview

- One of the Fastest growing FIDAS practice outside Big 4.

- Delivered Marquee Forensic engagements which enable us to take a lead position in Banking Fraud Solutions.

- Enhanced capabilities in Arbitration and Dispute to assist leading India and Global Law Firms.

- During last 5 Year (YOY) CAGR growth of 40%

Staff Competencies

- Multidisciplinary team consisting of Partners, Associate Partners, Director, Associate Directors, Managers, Senior Consultants, Consultants etc., with expertise into the Forensic domain.

- Team consists of CA, CFE, Lawyers, MBA and Digital Forensic experts.

- A network of Market Intelligence professionals with expertise in carrying out cross border source/ field enquiries discreetly.

Center Of Excellence

- Arbitration, Disputes & Litigation Support

- Managed Document Reviews (MDR)

- Anti – Money Laundering (AML)

- eDiscovery

- Third Party Due Diligence & Forensic Data Analytics

Technology & Data Analytics

- Relativity

- Access Data FTK

- Nuix

- Intella

- Encase

- Tableau

- Power Pivot

- ACL

- SQL Server

- Database

Specialised Skill Set & Experts Network

- Network of Ex-Enforcement officials to provide niche services of Market Intelligence and Assets Tracing.

- Network of Subject Matter Expert in sectors – Power, Steel, Infra and Telecom.

- Group of Inhouse and external panel of Experts for Testimony in Arbitration and Dispute cases.

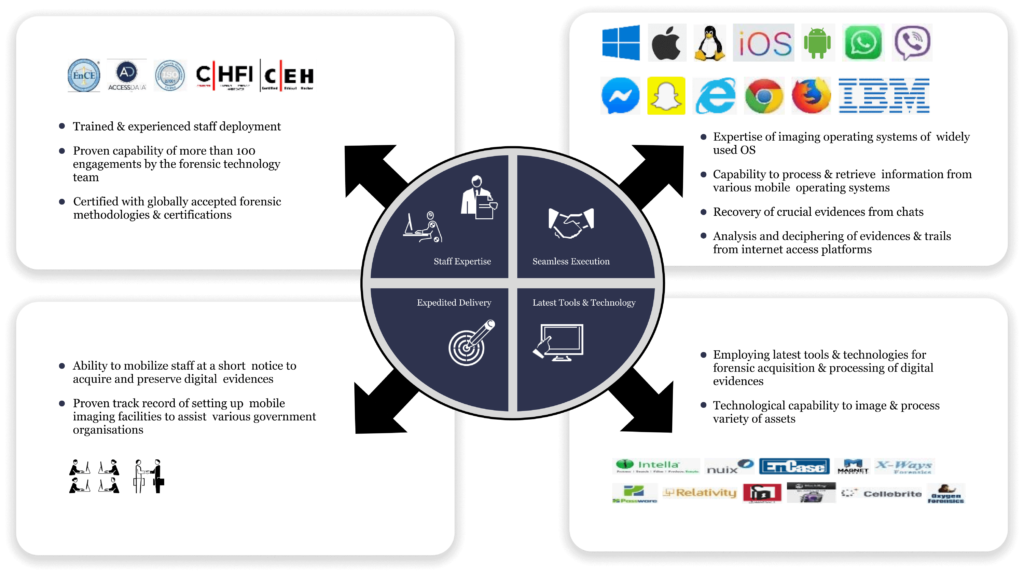

Digital Forensic Capabilities

Key Clients Overview

Potential Siphoning of Funds

Undisclosed & Indirect linked assets identified

Rollover of Funds Established

Loan Outstanding

Undisclosed related party Transactions

Bank Statements analyzed

Rollover of Funds Identified

Unveiled payments to Parties

Round tripping of funds routed through Cayman islands

Bogus companies suspended by SEBI

Undisclosed & Indirect linked assets identified

Review of shell companies carried out to identify instances of fund diversion and siphoning.

Imaging and Indexing

Assisted Securities and Exchange Bureau of India in ESI Imaging of target customer devices.

Assisted in Indexing of data and key word listing.

Employee Fraud

Kick Back from Contractors and Distributors

Documentation and Transaction Review

ESI Review of suspect employee’s

Assets Traced

Identified

Identified undisclosed and unencumbered assets in India and Dubai.

Treasury Fraud

Central Bank of Sri Lanka bond scandal which is also referred as CBSL bond scam was a financial laundering scam which happened on 27 February 2015 and caused losses of more than US$ 11 million to the nation

Forensic audit in respect of misappropriation of treasury bonds

Potential Loss

Assistance in Cyber forensic investigation against malware attack.

Review of security systems.

Arbitration Claim

Review of Arbitration Document

Review of Electricity Industry data

Review of Distribution Franchisee Agreement

Review computation of Claim amount.

Diamond Jewellery Company

DIAMOND INDUSTRY

$2 Billion

Potential Siphoning of Funds

$ 120 Million

Undisclosed & Indirect linked assets identified

$ 9 Billion

Rollover of Funds Established

Forensic Audit, Global Assets Tracing, Expert Testimony and Digital Investigation

Leading PE Fund

TELECOM INDUSTRY

$ 7 Billion

Loan Outstanding

$ 10 Million

Undisclosed related party Transactions

500+

Bank Statements analyzed

Forensic Audit and Fund Trail review of Key Group Companies

Large Oil & Gas Company

OIL & GAS INDUSTRY

$ 3 Billion

Rollover of Funds Identified

$ 1 Million

Unveiled payments to Parties

$ 500 Million

Round tripping of funds routed through Cayman islands

Forensic Audit, Fund Trail and FEMA review of Key Group Companies